palm beach county business tax receipt phone number

If you encounter a feature on our website that you cannot access due to disability please contact us. Palm Beach County Tax Collector Attn.

Local And County Tax Receipt Laws In Palm Beach County

Information about a lawyers license can be obtained by contacting the Bar by phone or in person.

. Business Tax Department PO. In some cases if a business performs several functions it may be necessary to acquire more than one local. However the homeowner has a responsibility under the law to notify the Property Appraiser if the ownership status of the property has.

The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg flood control districts sanitation districts. Find Palm Beach County residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records more. Palm Beach County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Palm Beach County Florida.

View information about obtaining and renewing a Palm Beach County. Box 3353 West Palm Beach FL 33402-3353. If you cant pay your ticket in full we can help you establish a monthly payment plan.

CUSTODIAN OF PUBLIC RECORDS. Property taxes are collected by the county although they are governed by California State LawThe Tax Collector of Riverside County collects taxes on behalf of the following entities. To pay by phone call the nCourt payment center at 561 207-7189.

See the FLHSMV What to Bring page for more details on the approved forms of documentation required for renewal. Free Palm Beach County Property Records Search. 1 2010 you need to bring with you one form of primary identification two proofs of address and proof of your social security number.

Payments can be made Monday through Friday from 8 am. Sign up to receive your bill electronically. Click the link to your city below to apply for a business license.

Columbia County Tax Collectors Office. Subject to regulations of zoning health and any other lawful authority Section 17-17 of Palm Beach County Ordinance No. Office of the Monroe County Tax Collector 1200 Truman Ave Ste 101 Key West FL 33040 305 295-5000.

Business Tax Receipt Handyman Disclaimer 1572 downloads Business Tax Complaint Form. Many businesses will be subject to zoning codes. The Columbia County Tax Collectors office is committed to ensuring accessibility to this website regardless of disability.

A 6 percent service charge will apply. Make sure to select Business Tax as your appointment type. The vendor must obtain a permit from the PBC Engineering Department and a Business Tax Receipt from the PBC Tax Collector.

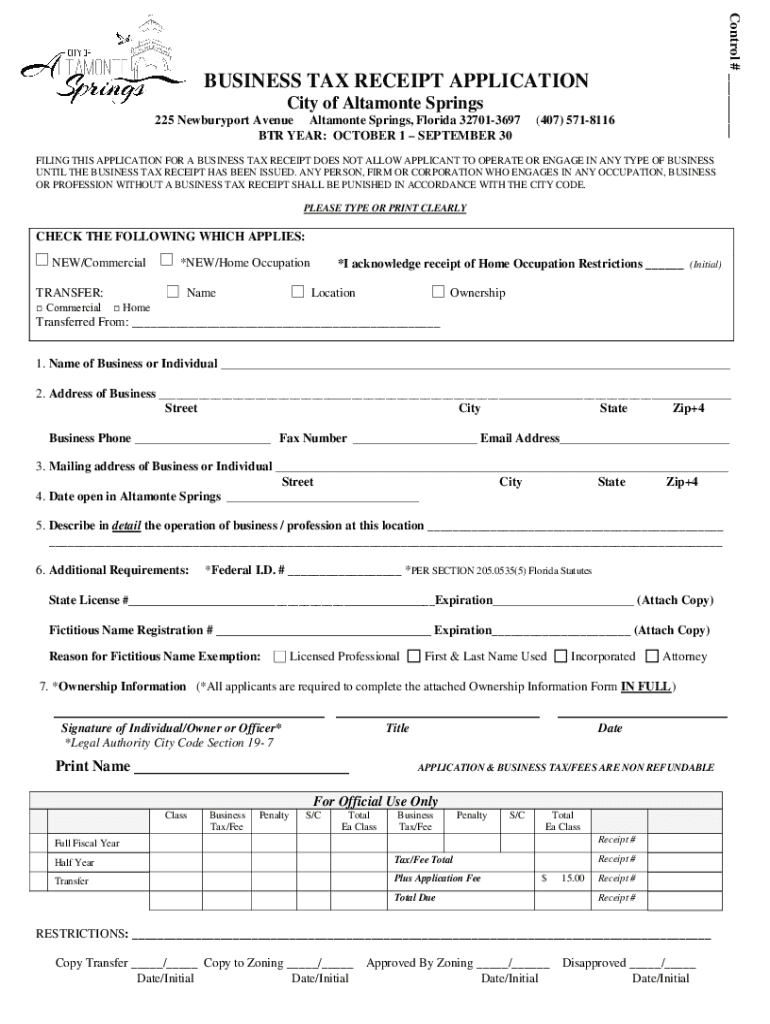

Business Tax Department PO. If you do not have any changes you can keep the receipt as proof that you are eligible for the automatic renewal. You are required to complete the correct application see Forms pay fees and in most cases have inspections in order to comply and be issued a local business tax receipt formerly known as occupational license.

In Okaloosa County a business located within a city limit requires both a municipal license and a county license to. Box 3715 West Palm Beach FL 33402-3715. Dear Citizens as your Tax Collector I am committed.

If you have not been issued a drivers license in person since Jan. Search for Palm Beach County business tax records by owner name business or trade name local business tax receipt number or address. Business Owner Enter by Last Name First Name LBTR.

Box 3353 West Palm Beach FL 33402-3353. Steele Monroe County Tax Collector 1200 Truman Ave Ste 101 Key West FL 33040 The Monroe County Tax Collectors Office is. Palm Beach County Tax Collector Attn.

These records can include Palm Beach County property tax assessments and assessment challenges appraisals and income taxes. Mail completed application to. For example you may need to contact the IRS for a federal employers ID number or the Orange County Business Tax Office for an Orange County tax receipt.

You will also continue to receive your annual tax notice on or before November 1. A Local Business tax is issued by the Tax Collector for the privilege of operating a business. Under TaxSys Search enter a name address or account folio number.

Florida - Statewide Contact Info. Before an Okaloosa County Business Tax Receipt can be obtained a business must meet all conditions required by the city county state or federal agency regulations which apply to that business or occupation. And on weekends from 10 am.

If your business is located within an incorporated municipality city limits a City Business Tax Receipt must be procured before a Brevard County Business Tax Receipt can be issued. The Miami-Dade County Tax Collectors Office now offers property owners the convenience of receiving their 2022 Tax Bill electronically. The NOC must be recorded at Palm Beach County Recording Department located at 205 N Dixie Hwy.

Once your application has. Your certificate of insurance for general liability and workers compensation Must have City of West Palm Beach 401 Clematis Street West Palm Beach Florida 33401 as the certificate. Business tax is regulated by Florida Statute Chapter 205 as.

Business tax is a tax you pay to the City for the privilege of doing business in the City. Anyone providing merchandise or services to the public even through a one-person company or home-based occupation must obtain a county business tax to operate. Okaloosa County Tax Collector 1250 N.

Certain types of Tax Records are available. If you are serving food you will need to contact the Department of Agriculture at 800 435-7352. Contact Numbers for Information.

This is referred to as roadside vendor and is issued for prepared foods flowers plants or produce only. Alcohol being served or sold at your business will require that you apply for and be issued a alcoholic beverage license. The Property Appraiser mails out in January an Automatic Residential Renewal Receipt to every homesteaded property owner.

Attend driver school in lieu of receiving points on your license. Information pertaining to Business Tax Receipts Brevard County Tax Collectors Office 321-264-6969 or 321-633-2199. Palm Beach County Tax Collector.

Select Property Tax then select Search and select. Box 3353 West Palm Beach FL 33402-3353. You may call us at 386-758-1077 or you can send us a message.

Make an appointment at one of our service centers to process your completed application. Your business tax receipt from the city or county your business is domiciled in. Complete the Application for Local Business Tax Receipt.

Constitutional Tax Collector Serving Palm Beach County PO. Pay your ticket online by mail by phone or in person at one of our courthouse locations. Contact Engineering - Traffic division at 561-.

Contact the County Tax Collector by phone at 904 630-1916 option 3 or visit the City of Jacksonville website for more information on obtaining a business tax receipt. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Gannon Constitutional Tax Collector Serving Palm Beach County PO.

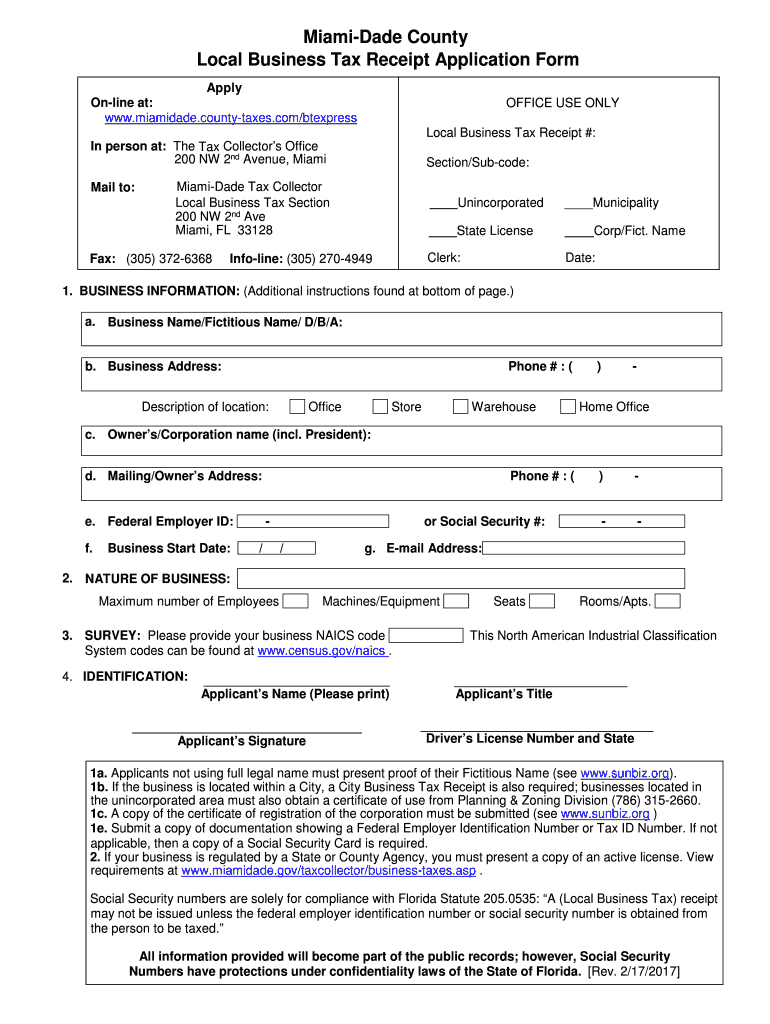

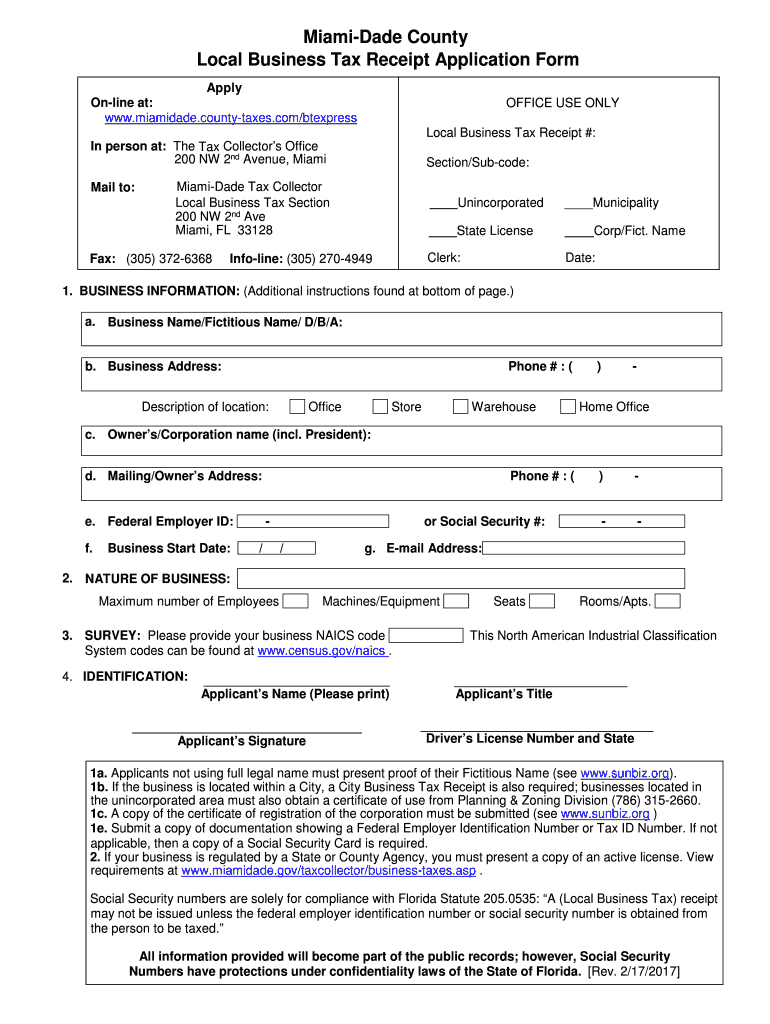

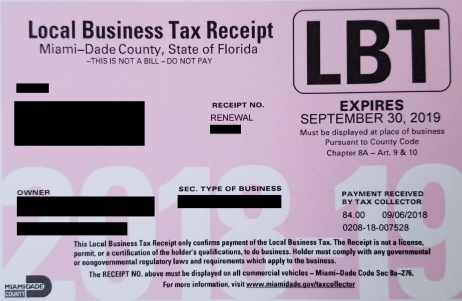

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

Permit Source Information Blog

Margate Area Broward County Local Business Tax Receipt 305 300 0364

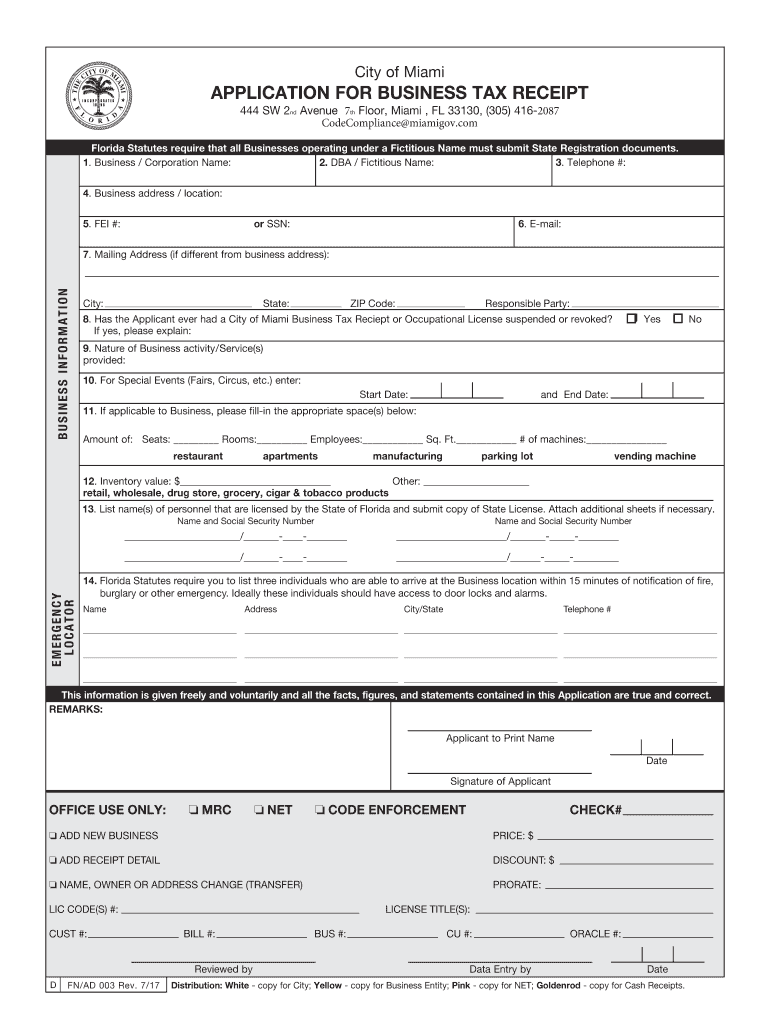

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Fl Business Tax Receipt Application Fill Out Tax Template Online Us Legal Forms

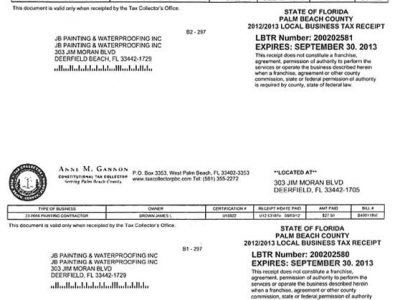

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc

Miami Dade County Local Business Tax Receipt 305 300 0364

Tourist Development Tax Constitutional Tax Collector

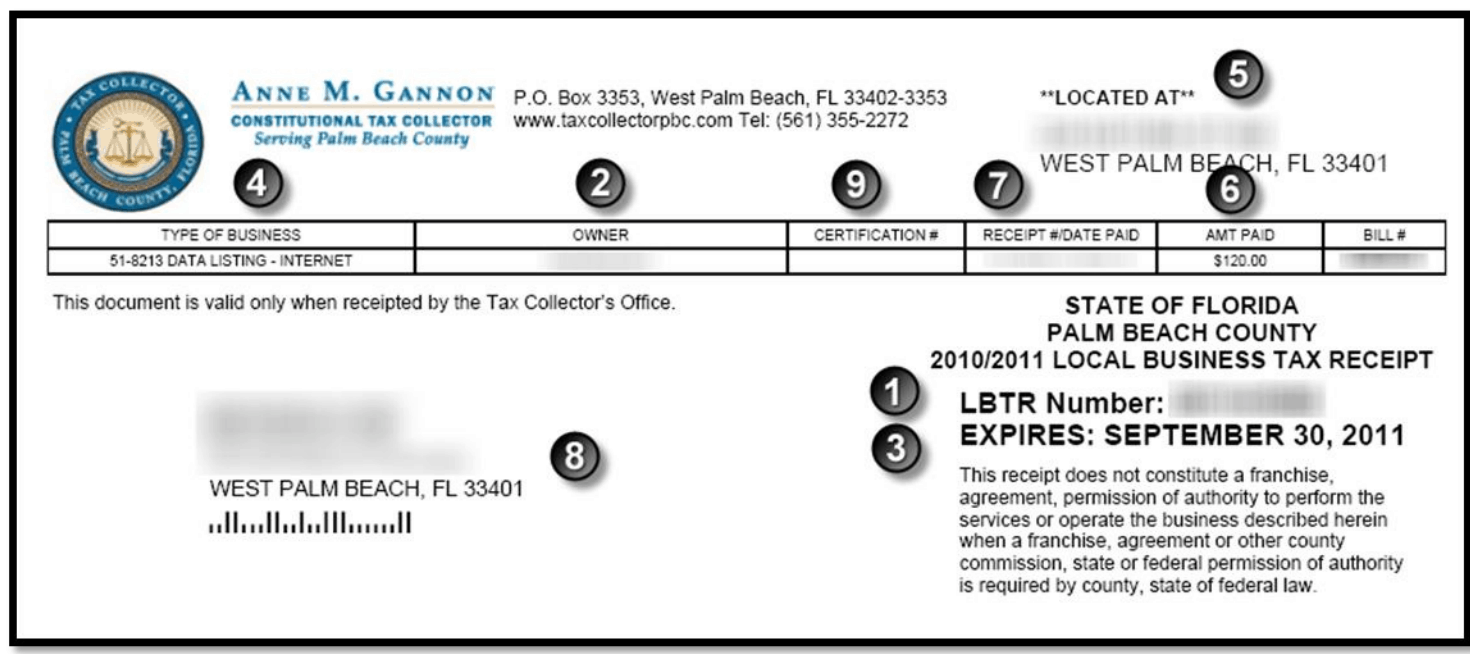

Palm Beach County Local Business Tax Receipt 305 300 0364